-

-

- Staff Hour

- FlowDesq

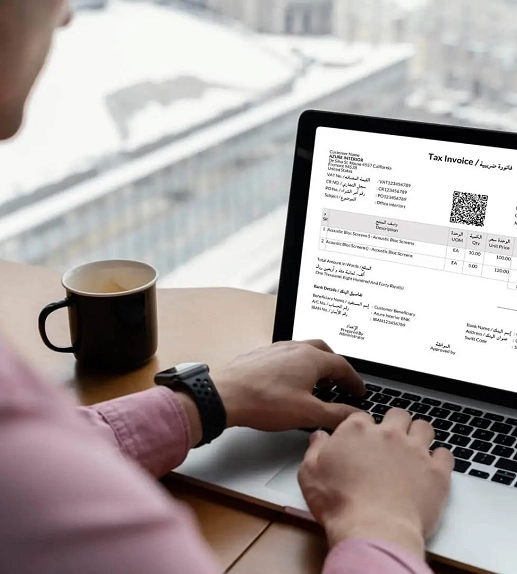

- Zatca E-Invoicing

- Event Management Software

- CRM Software

- Booking Management

- Touch2Scan

- Venue Management

- Study Abroad Software

- Rental Management

- Fleet Management Software

- School Management System

- Library Management Software

- Help Desk

- Delivery Management

- ERP for SMEs

- Document Management

- Project and Task Management

- Subscription Management

- Survey Management

- Visitor Desk

- Asset Management

- Recruitment Management

- Exam Management

- Procurement Management

- HR and Payroll Management

- E-Signature

- Point of Sales (POS)

- Digi Menu

- Property Management

- Learning Management System

- Manufacturing ERP

-preview.webp)