Saudi Arabia stands at the forefront of digital transformation, leading one of the most ambitious and impactful tech agendas in the world. With the introduction of the e-invoicing mandate, the Zakat, Tax, and Customs Authority (ZATCA) has ensured to build more accuracy, compliance and efficiency in their invoicing processes. Known as FATOORA, ZATCA E-invoicing software offers real-time reporting and builds a connection with their existing business systems.

With ZATCA approved e-invoicing software solution, businesses can firmly achieve compliance without disrupting their daily operations. The most efficient path to this goal is through direct integration with your Enterprise Resource Planning (ERP) and accounting systems. Because running a business in Saudi Arabia is not just about playing by the rules, it requires you to adhere to the strict structural alignment and relying on a versatile Odoo ERP platform is definitely the strategic business decision.

Understanding ZATCA’s Mandate

Fundamentally, the goals of e-invoicing under ZATCA are to increase accessibility, reduce tax evasion, and also accelerate VAT enforcement. This requirement, though, also offers the opportunity for businesses to improve the accuracy of reporting, refresh financial processes, and gain real-time operating visibility. Businesses can attain operational excellence and progress from mere compliance by implementing ZATCA E-Invoicing Software into accounting solutions such as the Odoo Accounting System or ERP solutions such as the Odoo ERP.

The rollout of the e-invoicing initiative has been structured in phases. Phase 1 of the mandate is focused on the generation of basic e-invoices in a specific format, and the ZATCA E Invoicing Phase 2, which is also known as the “Integration Phase,” requires businesses to integrate their invoicing systems directly with ZATCA’s platform. This phase enforces stricter standards for invoice generation, including cryptographic stamping, QR codes, and secure data transmission. With the advancements today, it is no longer reliable for businesses to rely on standalone or manual systems, and they need ZATCA-approved E-invoicing software which is capable of interacting in real-time with ZATCA’s centralized infrastructure.

Choosing Your ZATCA Approved E-Invoicing Software for Odoo

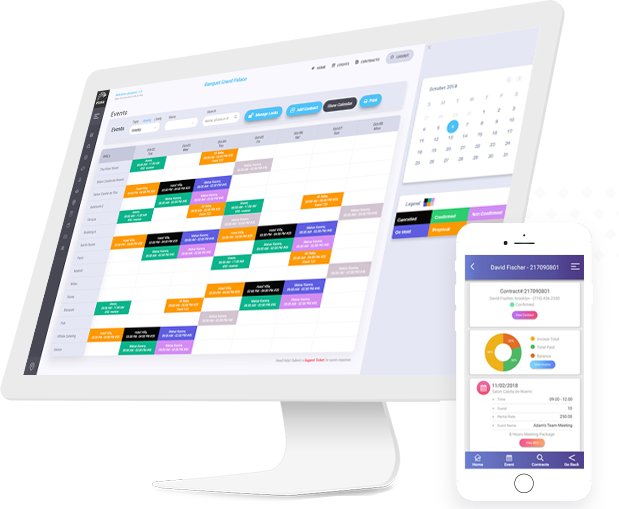

Well known for its all-in-one nature, Odoo smoothly integrates CRM, inventory, sales, and a robust accounting system into one platform. When combined with a ZATCA-approved e-invoicing solution, this environment becomes a completely compliant, automated process. For example, as soon as a sale order is confirmed and the invoice is validated inside Odoo, the ZATCA-integrated software generates the compliant XML file automatically, inserts the mandatory hash, and produces the required QR code all without requiring additional steps from the user.

Since invoice information is sent securely to ZATCA's Fatoora portal, the process is done in real-time, with the response being the accurate UUID and report status which is being logged immediately in the Odoo Accounting System. This ensures that any risk of manual errors is removed by also focusing on helping to provide an open, auditable digital trail. Through end-to-end automation of compliance, businesses shall be free of fines and still be absolutely accurate and efficient in their billing process.

Connecting E-Invoicing with Your Business Systems

Due to the challenges of systems integration and real-time data reporting, for a growing business, the path to ZATCA Phase 2 compliance can feel daunting. With the help of the right tech partner who offers you the right set of tools, a solution that is tailored to your requirements and that understands the unique pressures of E-invoicing in Saudi Arabia can be provided. This is mainly because they act as your guide and simplify the complexities between your daily operations and ZATCA requirements, and thus ensure a smooth, disruption-free transition.

Integrating a ZATCA-approved solution directly into this ecosystem unlocks an efficient flow of data. With Odoo integrated with ZATCA e-invoicing, compliance becomes even more enhanced and effortless. Because once a sales order is confirmed, with Odoo, invoices can be generated automatically with XML, hash, and QR codes. Data is securely transmitted to ZATCA’s Fatoora portal, with responses logged in Odoo, creating a reliable audit trail. This automation makes sure to eliminate manual errors, missed submissions, and ensures complete accuracy.

Navigating the Compliance Journey with the Right Partner

When picking a ZATCA-approved e-invoicing provider, don’t just settle for basic compliance. Choose one that works easily with your Odoo platform so you can easily meet all e-invoicing requirements in Saudi Arabia. Your ideal solution should provide native Odoo integration, operating as a smooth app within your current setting instead of a cumbersome third-party bolt-on increasing complexity. Opt for a provider with a track record, supported by past implementations and genuine user feedback, and ensure they provide full support to take you through the complex mandate, from initial set-up to ongoing compliance. This due diligence is the key to a successful and a sustainable move for your business growth.

From Mandate to Advantage: Transforming Compliance into Business Growth

Finally, the ZATCA E Invoicing Phase 2 is a driver for modernization. By implementing a highly integrated ZATCA E-invoicing Software solution for your Odoo ERP, you are not only just evading fines, but you are actually leveling up your financial process. This strategic decision enables you to automate cumbersome processes, removes expensive mistakes, and offers unmatched transparency thus giving you the freedom to free up valuable resources to focus on innovation and expansion. See this not as a finite compliance measure but is the foundation for a more effective and robust business. With the future of Saudi Arabia's economy wrapped around digital efficiency, participating in every aspect of it is essential for business who are looking forward to actively take in charge of the market.

.jpg )

Leave a comment