The idea of electronic invoicing has become increasingly popular in the corporate world in recent years due to its many advantages, which include lower costs, more efficiency, and improved security.

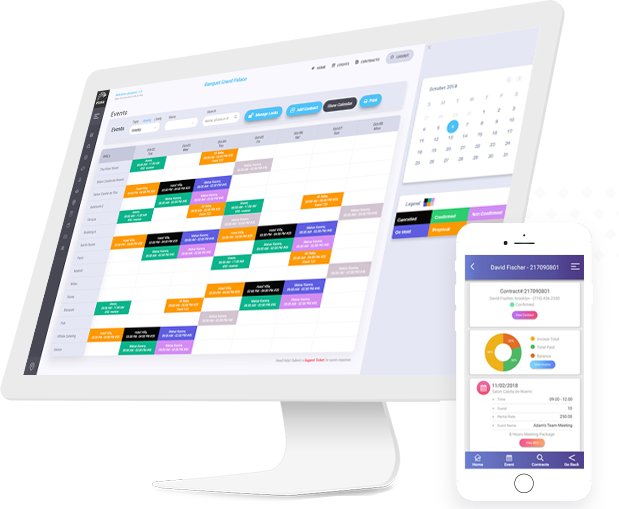

Odoo has designed an extensive module that fully integrates with the ZATCA e-invoicing system. This means that manual and paper-based processes are no longer necessary for businesses as they can easily create, transmit, and manage electronic invoices directly within their Odoo ERP system.

With features like real-time invoice tracking, greater data security, and simplified invoice generation, this module is going to completely change how Saudi Arabian firms handle their ZATCA e-invoicing.

Today, we will find out how customers have the option to make payments through a provided link or obtain information about the invoiced amount by scanning a QR code generated by the system.

Accounting and invoicing are critical processes that must be regulated in all business types. Unfortunately, a number of fraudulent actions have been reported because of different procedural flaws and vulnerabilities.

The Saudi Arabian Zakat, Tax and Customs Authority (ZATCA) is leading the way in e-Invoicing for VAT-registered sellers. ZATCA has published this rule and is getting ready to put it into effect. During the first phase, which begins on December 4 and ends on December 21, sellers must have ZATCA e-invoicing systems in place and follow its invoicing guidelines.

In the second phase of the roll-out, which is set to commence in January 2023, businesses that have already implemented systems will be required to connect their invoicing systems to the ZATCA's website for centralized governance and compliance. Consequently, system integrators undertaking this extensive e-Invoicing roll-out will be obliged to develop the system in accordance with the specifications outlined by the authority, ensuring strong integration with the governing authorities' / ZATCA's system/portal.

The second phase of ZATCA e-invoicing is scheduled to start in January 2023 and will require firms with systems currently in place to link their invoicing systems to the ZATCA website to provide centralized control and compliance. System integrators working on this large-scale e-invoicing roll-out will therefore need to design the system in compliance with the guidelines provided by the authority, guaranteeing strong integration with the system/portal of the governing authorities / ZATCA.

1. We can configure the Tax ID by heading to Settings.

An invoice will be created upon confirmation of the sale order. Specific E-Invoicing capabilities will become active or visible after the invoice has been verified.

We will get the invoice printed with the QR Code by going to Print -> Invoice.

The invoice with a QR code printed on it

We can either share the invoice by navigating to Actions -> Generate Payment Link and create a payment link. However, the QR code must be printed on the invoice, so the file will look like this after printing the validated invoice.

Results of QR Scanning.

.jpg )

Leave a comment